“Plenty of Gas Left in the Tank” Stock Market (and Sentiment Results)…

Comstock Resources Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

In late 2023, we came out publicly with a new position in Comstock Resources, a name that had been left for dead and one you practically couldn’t give away.

A combination of record domestic natural gas production flooding inventories, milder weather lowering demand, and being blindsided by policies slowing LNG export projects crushed the stock and sent natural gas prices to their lowest inflation-adjusted levels since they began trading on the NYSE in 1990.

We saw this as an opportunity and started adding around a $8/share basis, getting our hands on as many shares as we could as the stock drifted lower into the $7 range.

Two things stood out to us that made CRK a no-brainer:

First, we were investing pari passu with Jerry Jones. While he is best known as the owner of the Dallas Cowboys, few realize he built his INITIAL fortune in the OIL and GAS business and now controls ~71% OF THE ENTIRE COMPANY. His track record speaks for itself, and in public interviews he has openly stated that his oil and gas interests are worth WELL MORE THAN the Dallas Cowboys, AKA THE MOST VALUABLE SPORTS TEAM IN THE WHOLE WORLD at nearly $11B. We agree.

Second, Comstock is the LOWEST COST PRODUCER, with a cost structure that’s 48% LOWER THAN PEER AVERAGES. We believe in the long-term Nat Gas theme, and Comstock is undoubtedly the most efficiently run pure play in the space. In other words, they outperform peers when prices are in the doldrums, and when the cycle inevitably turns, they have the greatest operating leverage.

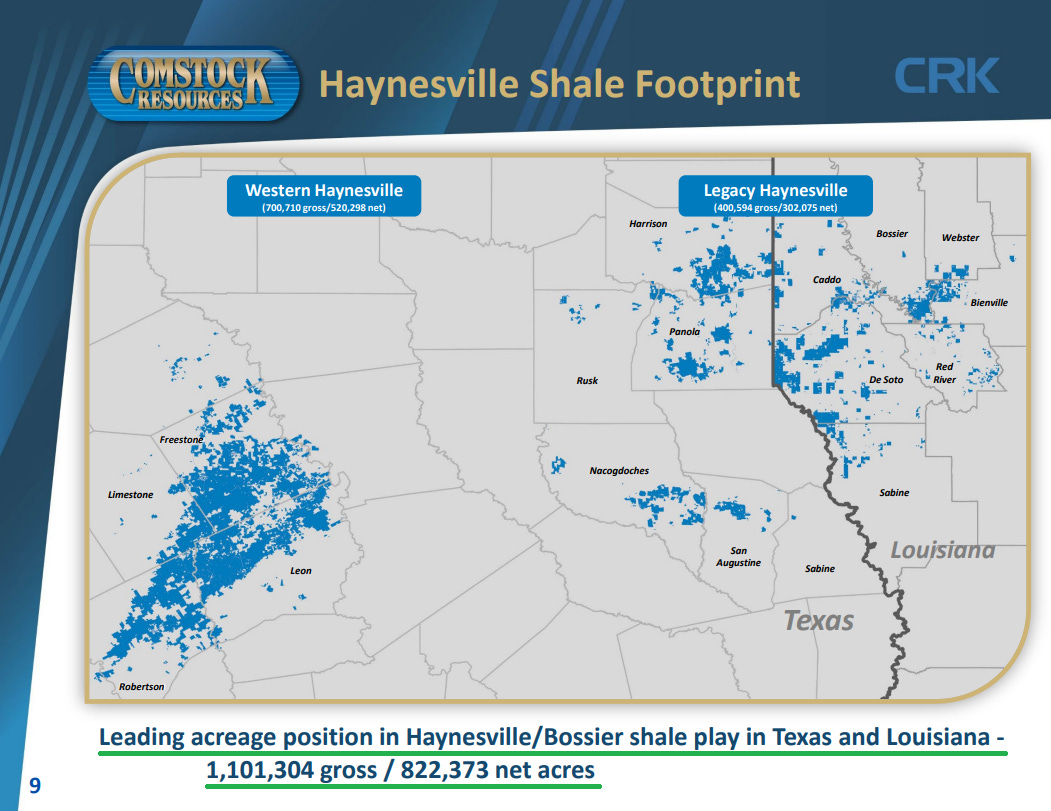

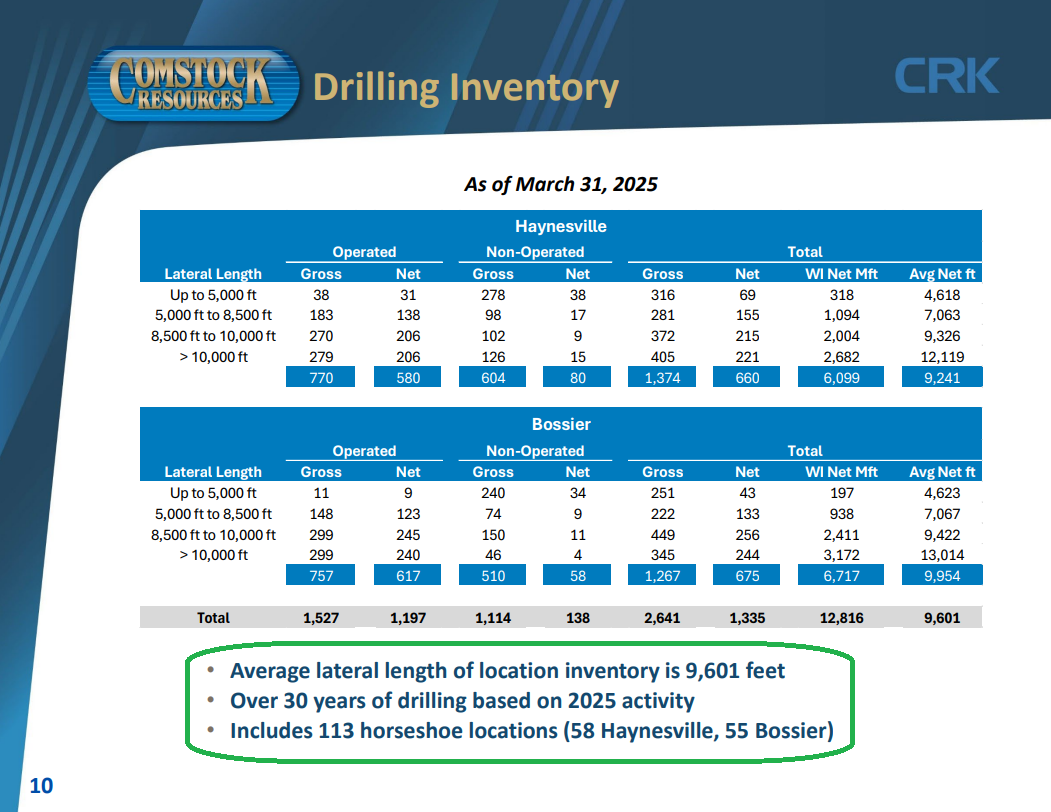

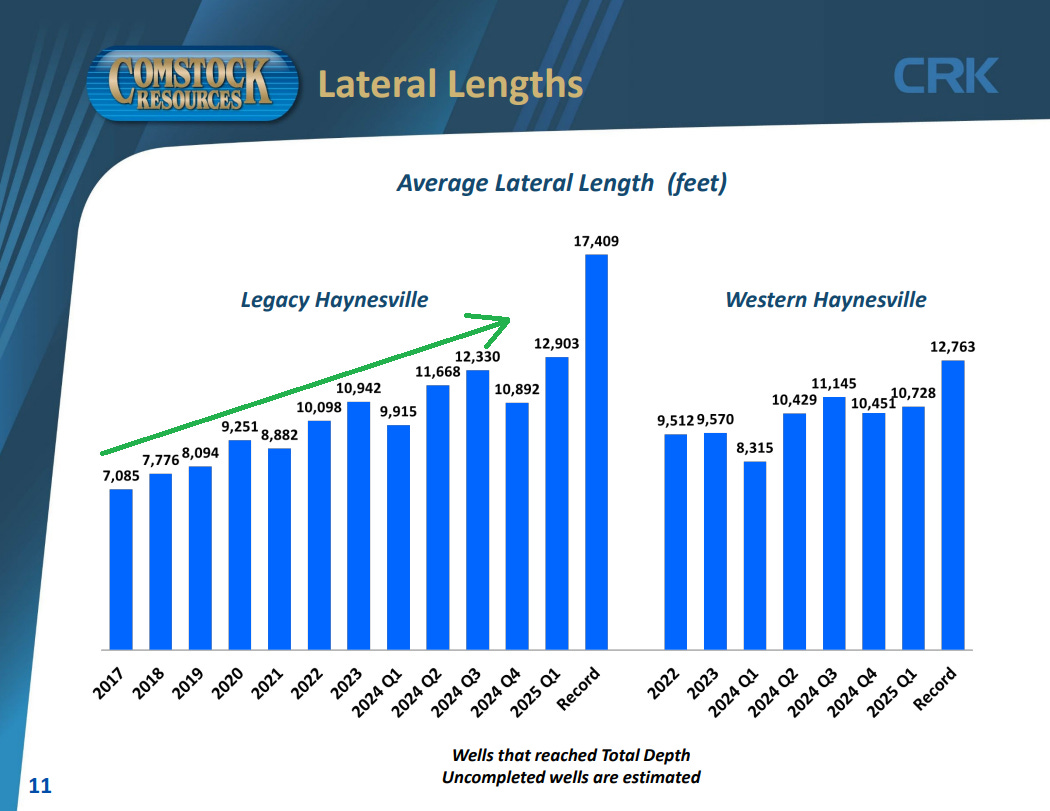

The best part, and something that wasn’t even baked into our original investment thesis, is that while prices were in the gutter and much of the industry was hiding under their desks in the fetal position, CRK was quietly playing offense, looking for their next big drilling opportunity. Management spent the last five years studying geologic data and signing over 20,000 new drilling leases across a massive 520,000 net acre footprint in the Western Haynesville region. This region is still virtually undeveloped, with management calling it the “holy grail” because they expect it to yield significantly more resource potential per section than their legacy Haynesville assets, with potential for THOUSANDS of future drilling locations.

For context, the legacy Haynesville region has 1,300 net locations and 904 net producing wells across 302,000 net acres. Western Haynesville covers 520,000 net acres but currently only has 19 net producing wells. By all means, this is still EARLY DAYS…

Meanwhile, it is perfectly situated about 100 miles from both Houston and Dallas, prime locations for future data centers that management is already in discussions for. This is on top of its proximity to the Gulf, which is home to more than $100 billion in LNG terminals and continues to rapidly expand.

With LNG capacity growing and AI and data centers driving electricity demand to record levels, the real question over the next few years will be: where will all the natural gas come from? Comstock will happily be there to answer just that.

Oh and by the way, this is all happening while managers are still sitting near RECORD LOW ALLOCATION to the energy sector. This move will be hated on the way up and chased when it’s too late. We’ll be smiling so wide we could eat a banana sideways…

Earnings Call Highlights

A few weeks ago, Alibaba released its annual letter to shareholders. Despite the PRICE ACTION (which we welcomed, as it gave us a chance to put new money to work for the first time in a while), the biggest takeaway is that the business continues to fire on all cylinders. Nothing we didn’t already know, but here are a few highlights worth noting:

International Commerce remains on track to achieve its first profitable quarter in the coming fiscal year.

Other previously loss-making businesses are now on track to reach profitability.

Revenue from AI-related products posted triple-digit growth for seven consecutive quarters, helping drive overall Cloud revenue back into double-digit growth.

Management repurchased $11.9 billion worth of shares during the year, reducing the share count by 5.1%. This was on top of $4 billion in dividends and special dividends paid during the year, with another $4.6 billion in dividends already announced for the current year.

Alibaba remains the #1 e-commerce platform in China, with total e-commerce now making up nearly 27% of retail consumption and reaching over 1.1 billion internet users. Management is doubling down on instant commerce, offering nearly $7 billion in coupons over the next year to gain share. Daily orders have already reached 80 million, and daily active users have passed 200 million (~40% market share in just three months).

General Market

The CNN “Fear and Greed Index” ticked up from 66 last week to 76 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 99.30% this week from 81.41% equity exposure last week.

Congratulations to all of the new clients that came in during our Q1 and Q2 2025 raises. You could not be better positioned for what we believe will continue to be a highly rewarding remainder year in 2025. This view is based on what has already taken place in 2025 as well as much of the data we have shared in recent weeks on our podcast|videocast(s), coupled with our proprietary methods of expressing and executing upon those views on your behalf.

As of July 1st, we are now accepting smaller accounts of $1M+ for our Q3 opening. We will close this opening early than normal this quarter and will stop accepting these accounts after today, July 9.

Congratulations to all of you I had the pleasure of speaking with and on-boarding last week. Most of you have already had your applications approved by IB so we have already begun deploying capital on your behalf.

To see if you qualify and to take advantage of this opening click here. Larger normal size accounts of $5-10M+ can access bespoke service at their preference here.

Not a solicitation.

*Opinion, not advice. See terms.