“There’s a Pony in This Pile” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Tuesday, I joined Stuart Varney on Fox Business’s “Varney & Co.” to discuss markets, outlook, the Fed, inflation, and more. Thanks to Stuart, Christian Dagger, and Peyton Jennings for having me on:

Watch in HD Directly on Fox Business

On Monday, I joined Taylor Riggs, Brian Brenberg, Jackie DeAngelis, and Dagen McDowell on Fox Business’s “The Big Money Show” for the full hour to discuss markets, outlook, stock picks, and more. Thanks to Taylor, Brian, Jackie, Dagen, Cassie Loeloff, and Madison Murtagh for having me on:

On Monday, I joined Josh Lipton on Yahoo! Finance’s “Market Domination” for the full one-hour show to discuss markets, outlook, stock picks, and more. Thanks to Josh and Taylor (Smith) Clothier for having me on:

Watch in HD directly on Yahoo! Finance – Clip 1

Watch in HD directly on Yahoo! Finance – Clip 2

Watch in HD directly on Yahoo! Finance – Clip 3

Watch in HD directly on Yahoo! Finance – Clip 4 (Full Hour)

On Wednesday, I joined Caroline Woods on NYSE TV to discuss markets, outlook, stock picks, inflation, and more. Thanks to Caroline, Kristen Scholer, and Mel Montanez for having me on:

Watch in HD Directly on NYSE TV

On Wednesday, I joined Diane King Hall on Schwab Network to discuss markets, outlook, NOV, AAP, GOOS, and more. Thanks to Diane and Mya Seals Hill for having me on:

Watch in HD Directly on Schwab Network

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 211 institutional managers with ~$504B AUM:

Here were the 5 key points:

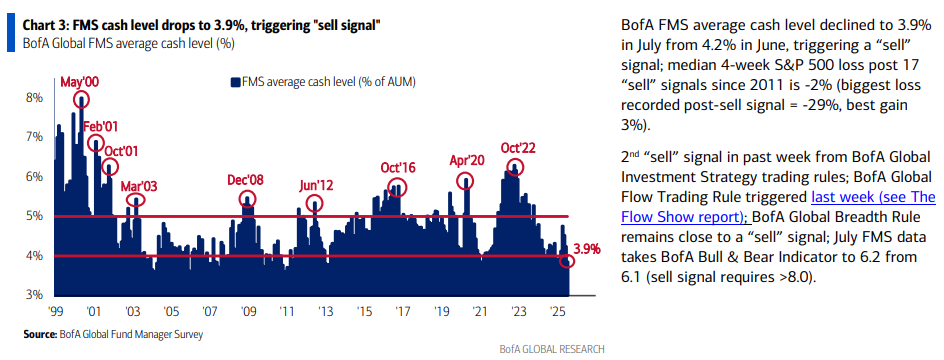

1) Average cash levels among fund managers have dropped to just 3.9%, triggering a BofA “Sell” signal. Since 2011, the median 4-week return for the S&P 500 following this signal is -2%. This likely sets the stage for the market to flush out the weak hands, AKA the trapped bears who puked in the hole in April and were forced to chase back in at all-time highs, before the next leg higher.

2) Opinion follows trend. Allocation to European equities has climbed to a four-year high, with 41% of managers net overweight, up from a mere 1% in January. We were on an island with that call heading into the year as part of our “Last Shall be First” thesis, pounding the table on international outperformance thanks to a weaker dollar.

3) 81% of managers now expect at least 1 rate cut in 2025, with 47% expecting 2 cuts.

4) 42% of managers expect Q2 earnings to surprise to the upside. This has been a theme we’ve been talking about in recent weeks. The bar hasn’t been this low for quarterly earnings in nearly two years, with estimates cut to just 4.8% from 9.3% earlier in the year — yet another catalyst to the upside.

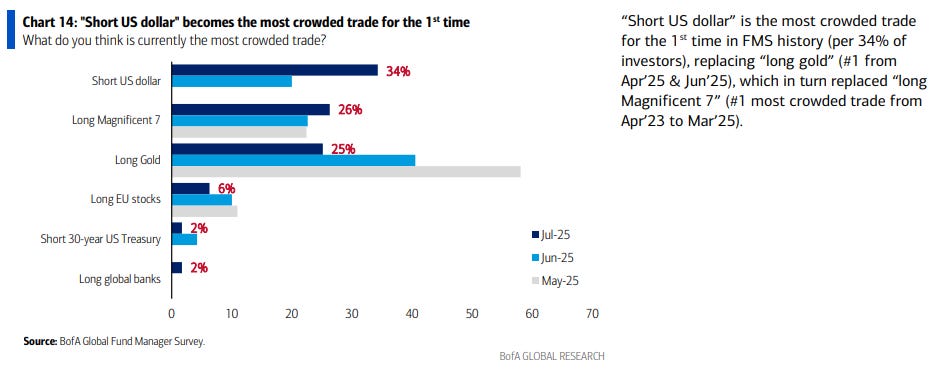

5) Now that the dollar has had its worst start to the year in ~50 years, “Short US dollar” is the most crowded trade for the first time ever. And just as you’d expect when a trade becomes “obvious” and the Johnny come latelys pile in, the market does what it always does and flushes them out, with the dollar seeing a solid short term bounce off the lows over the past 2 weeks.

National Oilwell Varco (NOV) Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

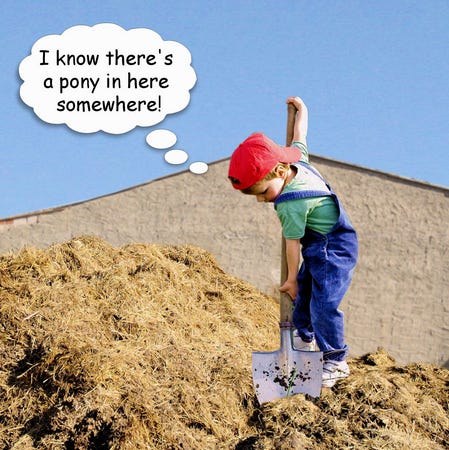

There’s a pony in this pile:

The joke concerns twin boys of five or six. Worried that the boys had developed extreme personalities – one was a total pessimist, the other a total optimist – their parents took them to a psychiatrist.

First the psychiatrist treated the pessimist. Trying to brighten his outlook, the psychiatrist took him to a room piled to the ceiling with brand-new toys. But instead of yelping with delight, the little boy burst into tears. “What’s the matter?” the psychiatrist asked, baffled. “Don’t you want to play with any of the toys?” “Yes,” the little boy bawled, “but if I did I’d only break them.”

Next the psychiatrist treated the optimist. Trying to dampen his outlook, the psychiatrist took him to a room piled to the ceiling with horse manure. But instead of wrinkling his nose in disgust, the optimist emitted just the yelp of delight the psychiatrist had been hoping to hear from his brother, the pessimist. Then he clambered to the top of the pile, dropped to his knees, and began gleefully digging out scoop after scoop with his bare hands. “What do you think you’re doing?” the psychiatrist asked, just as baffled by the optimist as he had been by the pessimist. “With all this manure,” the little boy replied, beaming, “there must be a pony in here somewhere!”

There are many parallels between the classic “pony in the pile” joke and the Energy sector right now. The sector has been in the doghouse all year, posting some of the worst returns among all sectors, and at this point, you pretty much can’t give it away.

In fact, managers are only just coming off RECORD LOW allocation levels from May and still remain net 23% underweight the sector.

Meanwhile, Energy’s weight in the S&P 500 has fallen back to all-time lows of just ~3% — levels we haven’t seen since oil went negative during the pandemic. That was an opportunity we happily took advantage of by buying as much Exxon Mobil as we could get our hands on, which ended up being a MULTIBAGGER in short order.

What makes us especially interested is that despite being essentially left for dead with record low exposure, the sector continues to see strong earnings growth revisions for 2026. It is now expected to deliver the highest growth of any sector, with estimates calling for 20.8% growth.

That kind of short-term voting machine versus long-term weighing machine divergence is music to our ears here at Great Hill Capital, and we’ve wasted no time over the past couple of weeks digging through the “pile” to find our next “pony.”

Comstock has been our go-to-name for exposure to the sector and a huge winner for us, but it hasn’t come down enough to justify putting new money to work. We then looked at opportunities in the exploration and production space, and while some names are starting to look cheap, they haven’t pulled back enough relative to the underlying price of oil.

But after combing through company after company, we finally found what we were looking for – our next pony. That brings us to our newest position, National Oilwell Varco (NOV), which we revealed during media appearances this week.

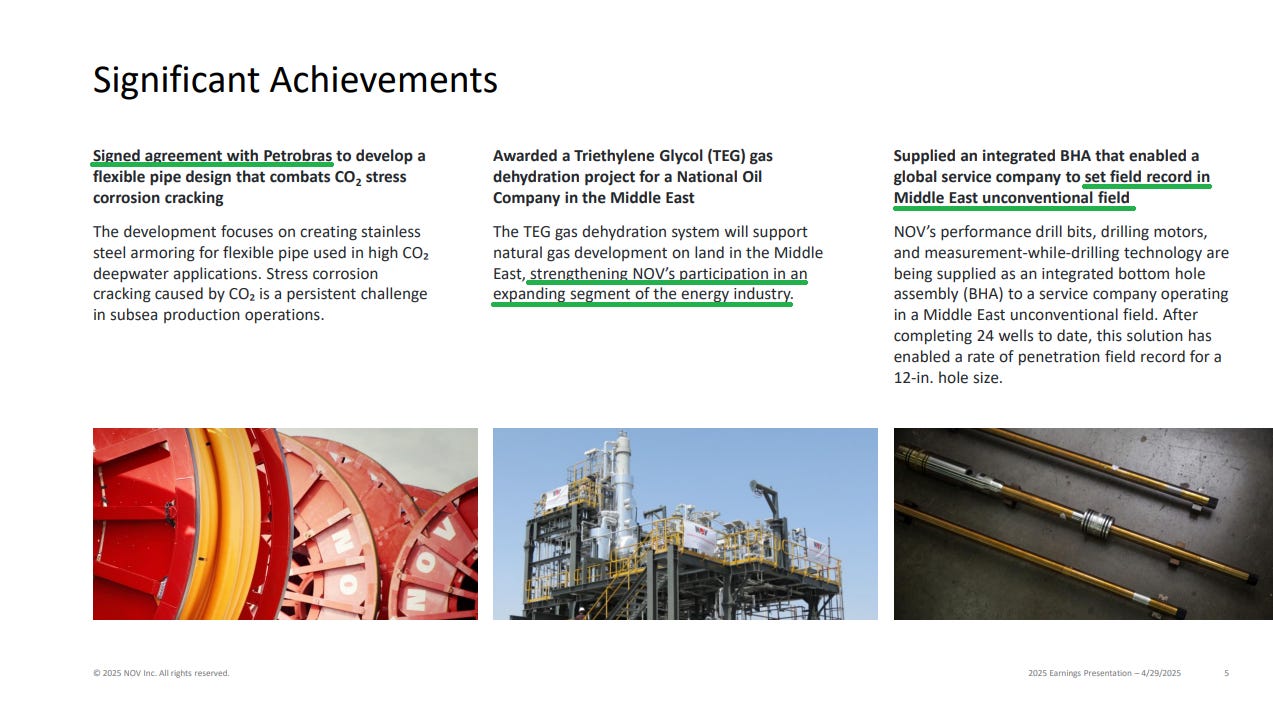

NOV is the largest OEM of rig systems for both onshore and offshore oil and gas drilling. They’ve dominated more than half the market for over two decades and built the largest installed base of rig equipment in the industry. That positioning has allowed them to tap into a lucrative aftermarket services business, creating a recurring, high-margin revenue stream that’s helped somewhat insulate the company from the usual cyclicality of oil and gas. Aftermarket now accounts for ~24% of sales and has been a key driver behind the company’s 14 consecutive quarters of EBITDA margin expansion.

That kind of top-line protection offers us a highly attractive way to gain exposure to production without taking massive risk on the underlying commodity. On top of that, NOV has a rock-solid balance sheet with nearly $1.2 billion in cash, $1.7 billion in long-term debt, and the next debt maturity not until 2029. Free cash flow is the name of the game in any turnaround, and NOV checks that box as well, generating nearly $1 billion last year, all while sitting on a backlog worth more than $4.4 billion…

So with downside risk well protected, the next question is what the upside scenario looks like.

As we like to say, we skate to where the puck is GOING, not where it’s already BEEN. For the past decade, the oil production story has been all about shale. But now, with many of those fields plateauing and starting to roll over, and demand showing no signs of slowing, that leaves offshore as the only place left for growth. Thanks to new drilling technologies (many of which are credit to NOV), average offshore development breakeven costs have dropped from ~$75 a barrel to as low as $40 today. It’s safe to say the economics are finally working again.

Management is already seeing signs the cycle is turning and the trend is starting to play out. NOV is tracking 14 potential FPSO projects, the most in 3 years, with as many as 12 awards possible in 2025, each representing $100 million to $700 million in revenue. They also expect offshore development capex to grow more than 50% from 2025 to 2027 compared to the 2020 to 2024 average. As the cycle turns and more operators call up NOV for offshore, which already accounts for ~45% of their sales, that is when operating leverage really starts to kick in. At that point, NOV will be swimming in more cash than they know what to do with.

And while we wait for the cycle to rebound, they are returning at least 50% of excess free cash flow to shareholders through dividends and buybacks, with a current dividend yield of 4.1% and shares outstanding down ~3.4% over the past year.

Meanwhile, the market is still pricing NOV as if it’s going out of business. The stock trades at just over 4x cash flow, prices we haven’t seen since the 2001 lows right before the stock went on a 10x run.

With rates coming down and production getting more economical, paired with more favorable energy policy, we wouldn’t be surprised to see NOV catch a similar cycle and go on another multi-bagger run. For months now, we’ve been pointing out the similarities between today and the early 2000s, whether it’s small caps, international stocks, or value outperforming. But don’t forget, this was also when energy quietly became the top-performing sector of the decade.

History does not repeat, but it often rhymes…

Here’s everything you need to know about NOV:

Q1 Results

Earnings Call Highlights

Morningstar Analyst Note

General Market

The CNN “Fear and Greed Index” ticked up from 66 last week to 76 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 86.28% this week from 81.41% equity exposure last week.

Congratulations to all of the new clients that came in during our Q1, Q2, and Q3 2025 raises. You could not be better positioned for what we believe will continue to be a highly rewarding remainder year in 2025. This view is based on what has already taken place in 2025 as well as much of the data we have shared in recent weeks on our podcast|videocast(s), coupled with our proprietary methods of expressing and executing upon those views on your behalf.

As of last week, our Q3 raise is officially closed. Congratulations to everyone I had the pleasure of speaking with and onboarding last week. Most of you have already had your applications approved by IB so we have already begun deploying capital on your behalf. Larger normal size accounts of $5-10M+ can still access bespoke service at their preference here.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.